unemployment tax forgiveness pa

A 54 percent 054 Surcharge on employer contributions. Employer Tax Services.

Alex Peterson Alexpetersondli Twitter

President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an individual received in 2020.

. File and Pay Quarterly Wage. Box 67503 Harrisburg PA 17106-7503. Report the Acquisition of a Business.

Taxpayers who receive unemployment compensation are encouraged to watch their mailboxes during the tax season for the 1099G tax form that is required to file your. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. Record the your PA tax liability from Line 12 of your PA-40.

Record tax paid to other states or countries. Eligibility income for Tax Forgiveness is different from taxable income. The Self-Services that are available will vary depending on the.

For example a family of four couple with two dependent. Your canceled check or money order will be your receipt. Register to Do Business in PA.

In Part D calculate the amount of your Tax Forgiveness. 033 on up to 1743 of taxable income. Register for a UC Tax Account Number.

The surcharge adjustment is computed by multiplying your basic rate by the 54 percent surcharge. UCMS also offers TPAs the opportunity to manage UC Tax and account information online on behalf of their clients. Unemployment benefits are fully taxable in Iowa.

State Income Tax Range. Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven. All payments should be sent to Office of UC Benefits UI Payment Services PO.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Then move across the line to find your eligibility income. The Unemployment Compensation UC program provides temporary income support if you lose your job or are working less than your full-time hours.

Get Information About Starting a Business in PA. You may choose to have federal income tax withheld from your benefit payments at the rate of 10 percent of your weekly benefit rate plus the allowance for dependents if any. Are not required to file a PA-40 Individual Income Tax Return but would qualify for tax forgiveness if they were required to file are also.

Office of UC Benefits UI Payment Services PO Box 67503 Harrisburg PA 17106-7503. When making a payment by mail please send a cashiers check certified check or money order. State Taxes on Unemployment Benefits.

Written appeals should be sent to the Department of Labor Industry Office of UC Tax Services Employer Account Services PO Box 68568 Harrisburg PA 17106-8568. Dependent children whose parents grandparents etc. To claim this credit it is necessary that a taxpayer file a PA-40.

At the bottom of each column is an amount expressed as a decimal which represents the percentage of tax. The departments instructions allow dependent children to claim tax forgiveness because as the 1974 law identifies the intent of the General Assembly as described above. Eligibility income is greater because it includes many nontaxable forms of income such as interest on savings bonds.

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

View All Hr Employment Solutions Blogs Workforce Wise Blog

For Those Collecting Unemployment Benefits Tax Day May Come With A Surprise Expense They Can T Cover Pittsburgh Post Gazette

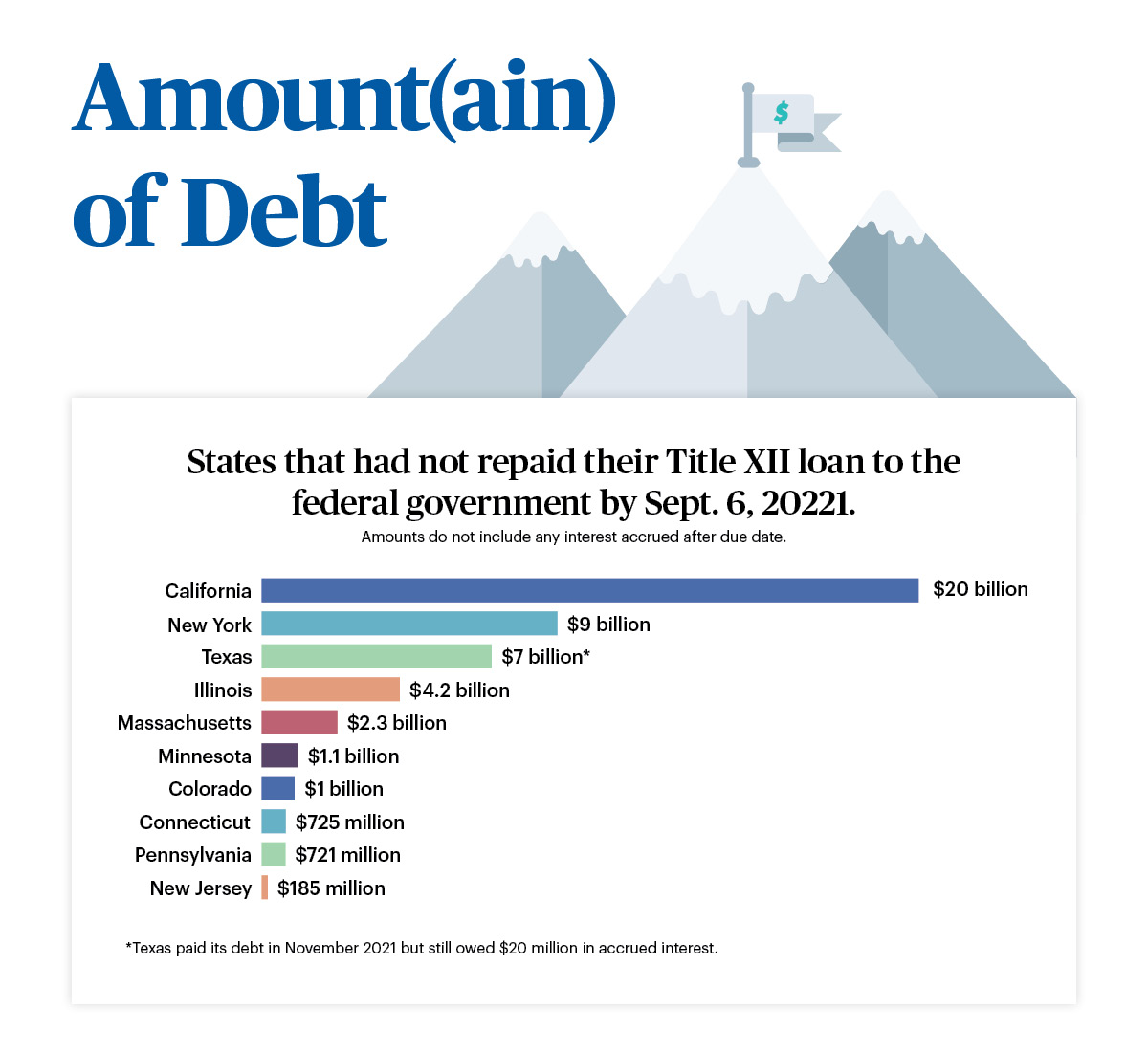

State Debt To The Federal Government Could Increase Payroll Taxes Paychex

Unemployment Benefits Tax Issues Uchelp Org

Don T Forget To Pay Income Tax On Your Unemployment Benefits Omni Tax Help

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

2022 Federal Payroll Tax Rates Abacus Payroll

Pennsylvania How Unemployment Payments Are Considered

D C Considers Tax Relief For Residents Getting Unemployment Aid Dcist

Which States Tax Student Loan Forgiveness And Why Is It So Complicated Tax Policy Center

Enews Updates August 14 2020 Senator Mario Scavello

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Pennsylvania S State Budget Is Officially Late Here S What You Need To Know Spotlight Pa

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

How To Apply For A Pennsylvania Property Tax Rebate Or Rent Rebate Spotlight Pa

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav